- Ribbon powered by EasyKnock is now live in select markets. Visit RibbonHome to get started.

Programs Designed for People Like you.

Sell & Stay

Sell your house, convert your equity to cash, and stay as a renter. Keep the option to buy the home back or direct us to sell it on the open market.

Sales Price

100%

of the home’s fair market value in cash funding + the Sell & Stay Option

Cash Funding

Up to 75%

of the home’s fair market value in cash

Lease Term

12 months

with annual renewal for up to five years total and the ability to exercise your Sell & Stay Option at any time

MoveAbility

Sales Price

100%

of the home’s fair market value in cash funding + the Sell & Stay Option

Cash Funding

Up to 75%

of the home’s fair market value in cash

Lease Term

12 months

with annual renewal for up to five years total and the ability to exercise your Sell & Stay Option at any time

What is a sale-leaseback?.

We’re glad you asked! A sale-leaseback is exactly what it sounds like; sell your property, but instead of having to move out, you stay as a renter. This concept is nothing new.

While common in commercial real estate, EasyKnock brought it to residential real estate.

The economy is changing, EasyKnock can help.

At EasyKnock, we’ve built innovative financial solutions that cater to the realities of the modern American homeowner.</b.

We’re different because we’re not a lender; that means you have fewer restrictions.

IN TODAY’S ECONOMY

$24,700

The average American between the age of 25-75 carries of non-mortgage debt1

$199,000

The average mortgage holder has in trapped home equity2

57% of Americans

Due to financial limitations of U.S. adults are uncomfortable with their level of emergency savings.3

Ronda's Story

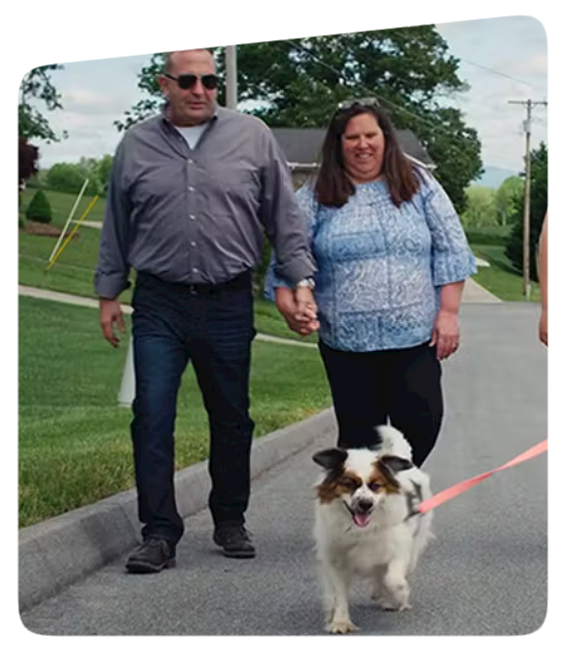

The McElwains' Story

The McElwain’s Story

“A family of four, two teenagers, we needed more room. With EasyKnock, we turned the full value of the home equity into the cash we needed in order to move. We sold our home and purchased our new home in just five weeks. It was amazing.”

Ready to make your home equity work for you?

See for yourself how EasyKnock’s sale-leaseback solutions help homeowners unlock their financial freedom.

Disclosures

- Rounded to the nearest tenth. (Dematteo, M. (Oct 3, 2023), CNBC. “The average Gen Xer has $32,878 in non-mortgage debt—here’s how they compare to other generations”)

- (Aug 7, 2023), Black Knight. “Home Prices Hit New Record Highs in 60% of Major Markets as Annual Growth Rate Rises, Boosting Homeowner Equity Levels”

- Gillespie, L. (Jun 22, 2023), Bankrate. “Bankrate’s 2023 annual emergency savings report”

EasyKnock program parameters and requirements are subject to change without notice based on market conditions. These materials are promotional in nature and are not offered as advice and should not be relied on as such. EasyKnock, Inc. as well as its subsidiaries and affiliates (collectively “EasyKnock”) are not lenders and do not provide loans. The transactions described in these promotional materials are sale-leasebacks and involve the sale of the property to EasyKnock and subsequent lease of the property from EasyKnock. Some transactions include an Option Agreement. The ability to repurchase a property via the Option Agreement depends on the specific product and product offerings vary by state. Terms and conditions apply. EasyKnock sale-leaseback products are not available in CA, DE, MA, MD, ND, NY, SD, VT, WA, and select markets.