- Ribbon powered by EasyKnock is now live in select markets. Visit RibbonHome to get started.

Sell & Stay

Sell, Rent, and Remain in the Home You Love

Convert your home equity into cash to pay debts, navigate a life event, and more while keeping the option to repurchase.

What is Sell & Stay?

Why choose Sell & Stay?

Keep the Option to Repurchase

Remain as a renter for up to five years total. At any point, you can choose to repurchase the home for the agreed-upon Buyout Cost

Avoid Lender Restrictions

We are not a lender. That means you won’t face credit score or debt-to-income (DTI) requirements.

Retain Appreciation

You maintain the rights to any home value appreciation over the agreed-upon Buyout Cost, minus agent commission if you direct us to sell at a later date.1

What do you stand to gain with Sell & Stay?

$6k+

Average annual home expenses paid by EasyKnock2

57%

of Sell & Stay homes appreciate3

5 weeks

Save time and money with a quick home sale

SELL & STAY FEATURES

Convert 100%

of the home’s fair market value into cash + Sell & Stay Option

Receive Up to 75%

of the home’s fair market value in cash

12 Month Lease Term

with annual renewal for five years total with the ability to exercise your Sell & Stay Option at any time

The Sell & Stay Option

How We're Different

Lenders*

CREDIT SCORE REQUIREMENTS

620+

None

DEBT-TO-INCOME REQUIREMENTS

~43-50%

None

CASH FUNDING

Up to 80%

Up to 75%

EXPENSES COVERED

INCOME VERIFICATION REQUIREMENTS

Strict

Flexible

How Sell & Stay Works

01

Get Qualified

02

Sign, Close, and Get Your Cash

There’s a traditional five week real estate home closing process.7 Once your home is sold to EasyKnock, you get the agreed-upon cash and your lease begins.

03

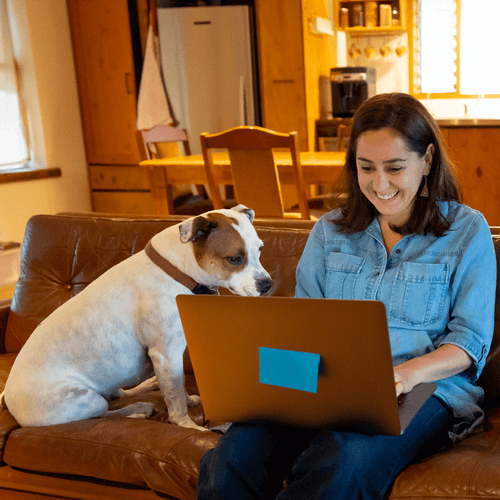

Stay in Your Home

You stay in the home as a renter while deciding on your next steps. You can choose to repurchase the home or direct EasyKnock to sell it on the open market.

Your Sell & Stay Buyout Cost

Once you’re ready to either repurchase the home or direct us to sell it on the open market, you will pay EasyKnock the Buyout Cost. Your Buyout Cost equals the Option Exercise Price, each year’s Option Fee (based on the length of tenancy), and any outstanding amounts.

- Option A: If you choose to repurchase your home, the Buyout Cost will be the Option Exercise Price + the Option Fees you pay based on the years of your lease. You will be responsible for the buyer’s closing costs.

- Option B: If you choose to sell on the open market, you will receive the final sale price minus the Buyout Cost and your agent commission. EasyKnock and the new buyer will cover the closing costs. You will also receive home value appreciation, if applicable.1</sup.

Associated Costs

INITIAL SALE

Processing Fee

As a MoveAbility customer, you pay a Processing Fee of 3.75% of the home value which will be taken out of your proceeds.

Closing Costs

You will be responsible for both the buyer’s and seller’s closing costs. These are ~1.5% of the home’s value but vary based on property location.8

SECOND SALE

Option Fee

Closing Costs

Erin’s Story

“After selling the house to EasyKnock, it’s just made things easier financially on us. It’s lifted a burden off our shoulders to be able to move forward and plan our budget for the future as opposed to worrying about previous debt.”

Ready to make your home equity work for you?

Disclosures

- Terms and conditions apply.

- Rating as of July 2024 via TrustPilot.

- As the property owner, EasyKnock pays the property taxes, property insurance and HOA dues on the property. Calculations are the average annual expenses rounded to the nearest tenth for a home in our portfolio acquired in 2022.

- Average appreciation rounded to the nearest tenth for Sell & Stay customers for homes sold in the open market between Jan 2022-Dec 2023.

- Average appreciation for Sell & Stay customers for homes sold in the open market between Jan 2022-Dec 2023.

- 4-6 weeks average – Timing varies based on external factors.

- The Letter of Intent is to inform EasyKnock of the intent to proceed with the application and its terms and fees.

- Sell & Stay customers can remain as a renter for up to five years total with the ability to exercise the Sell & Stay Option at any time.

- MoveAbility customers must direct EasyKnock to list the home within the first nine months.

- Sell and Stay® and MoveAbility® are registered trademarks of EasyKnock™, Inc.

EasyKnock program parameters and requirements are subject to change without notice based on market conditions. These materials are promotional in nature and are not offered as advice and should not be relied on as such. EasyKnock, Inc. as well as its subsidiaries and affiliates (collectively “EasyKnock”) are not lenders and do not provide loans. The transactions described in these promotional materials are sale-leasebacks and involve the sale of the property to EasyKnock and subsequent lease of the property from EasyKnock. Some transactions include an Option Agreement. The ability to repurchase a property via the Option Agreement depends on the specific product and product offerings vary by state. Terms and conditions apply. EasyKnock sale-leaseback products are not available in CA, DE, MA, MD, ND, NY, SD, VT, WA, and select markets.